Table Of Content

- What’s the average house price in each state?

- Columbus Ohio Housing Market in 2024: What You Need to Know

- A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up

- Typical home price in Louisiana: $195,544 (57% of typical U.S. price)

- Typical home price in Iowa: $205,139 (60% of typical U.S. price)

Cincinnati is one of the top-rated cities for families to move to in the state. The state of Alabama also has a relatively young median age, meaning it could be a good place for a young family to relocate. Montgomery is the state’s capital city and was an important part of the Civil Rights Movement.

What’s the average house price in each state?

The Sooner State is an affordable option whether you want a bucolic farmhouse, a more urban vibe in Oklahoma City or a college sports haven in Norman. “President Biden is on track to impose more regulatory cost on our economy than any President in history, adding $1.4 trillion since coming to office. This is a staggering 45 times the regulatory costs accumulated under President Trump and almost five times the regulatory costs added under President Obama.

Columbus Ohio Housing Market in 2024: What You Need to Know

The typical home in Wisconsin is valued at $279,390, and with a median income near the national median, the state boasts an above-average income-to-home-value ratio. The typical home value in South Dakota is 16% lower than the typical U.S. home value, while the median income in the state is just 7% below the national median. Massachusetts has the fourth-highest typical home value and among the lowest income to home value ratio, despite the median income in the state being 26% above the national median. The typical home in Louisiana is valued at $195,544, just 57% of the typical U.S. home value.

A Huge Number of Homeowners Have Mortgage Rates Too Good to Give Up

The state of Iowa is located squarely in center of the Midwestern United States, between the Missouri and Mississippi Rivers. The capital city of Des Moines is well connected by interstate highways to other major cities in the area and can make a great location for a home. New Jersey is located right next to very expensive New York City, and it’s common for people that work in the city to live across the Hudson River in New Jersey. Atlantic City is a popular seaside resort that also functions as the state’s gambling center. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers.

What is the median home price by state?

That leads to a high income-to-home-value ratio, despite the median household income in Louisiana being 26% lower than the national median. The typical Kentucky home is 43% cheaper than the typical U.S. home. Despite the median household income in Kentucky being 21% below the median U.S. income, the state has a high income-to-home-value ratio. Delaware homes are valued 8% above the typical U.S. home, offset by the median household income in the state being 10% above the U.S. median.

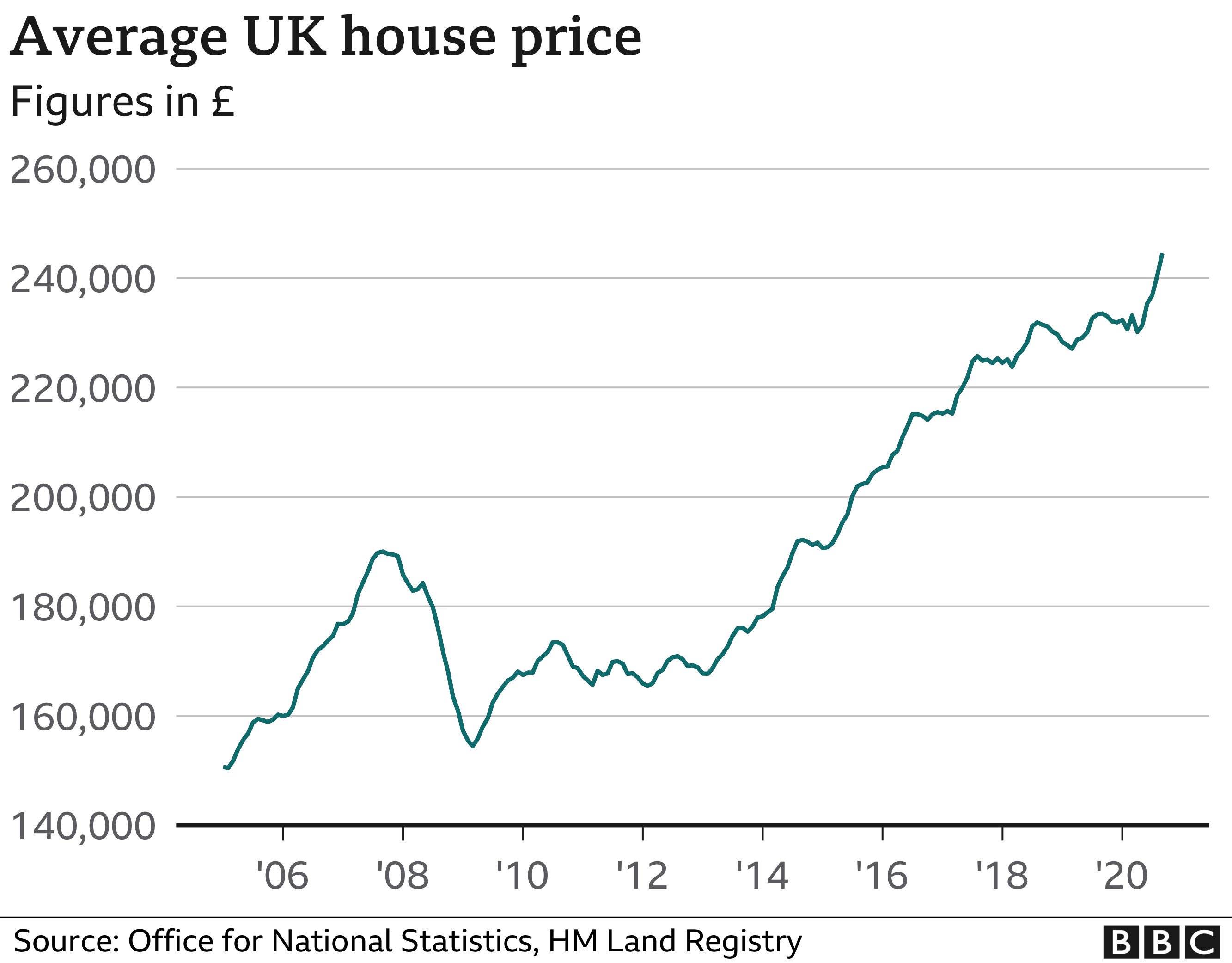

Property taxes are based on your home’s assessed value (which might not be how much you paid for the house) and your county and/or city tax rate. The national homeowner median for real estate taxes is 1.1%, but as you can see from the above chart, the total amount can vary quite a bit. For example, Phoenix and Miami homeowners pay roughly the same amount per month overall, but Miami homeowners pay far more in monthly taxes. Some of the difference may be due to an Arizona law limiting how much a home’s assessed value may increase year to year. The direction and pace at which home prices are changing are indicators of the strength of the housing market and whether homes are becoming more or less affordable.

California

Mortgage rates reached a peak of 18.6% in October 1981, although home prices were considerably lower, even on an inflation-adjusted basis, than today's values. West Virginia also had some of the lowest average wages in the country. The average earner made around $54,000, while the median home cost about $160,000. With a typical house price of only a small margin less than Massachusetts, Colorado is the fifth most expensive state for buying a home. Sometimes called the mile-high state, it has the highest mean elevation of any state in the US and some of the country’s tallest mountains. This makes it a highly popular winter tourism location for outdoor and snow-sport enthusiasts.

If you’re looking at Grand Rapids, expect a lower average home price at $272,446. The average down payment is 13% and is considered an interest rate of 7.32% on a 30-year mortgage. In the article below, we shall discuss the average house price in the USA, list some of the country’s most expensive and affordable states, US real estate trends, and predictions for the coming year. Our index relies on regional data for both the cost of housing and income. Conversely, Los Angeles’ relatively lower income in our data highlights the housing affordability crisis in that region. Your first monthly payment, including principal, interest, tax, and insurance (PITI), isn’t due alongside the other upfront payments.

Typical home price in Iowa: $205,139 (60% of typical U.S. price)

The average price peaked at $552,600 in the fourth quarter of 2022, which was the highest level since the series began in 1963. That familiar cheer from the crowd at Ohio State University football games isn’t just for touchdowns anymore; it’s for a housing market that feels like a win for anyone on a tight budget. The Buckeye State offers a balance of big cities like Cincinnati, Columbus and Cleveland with many smaller towns in-between. Yes, there a handful of states where you can pay less than the state’s average home price to get near the state’s best schools.

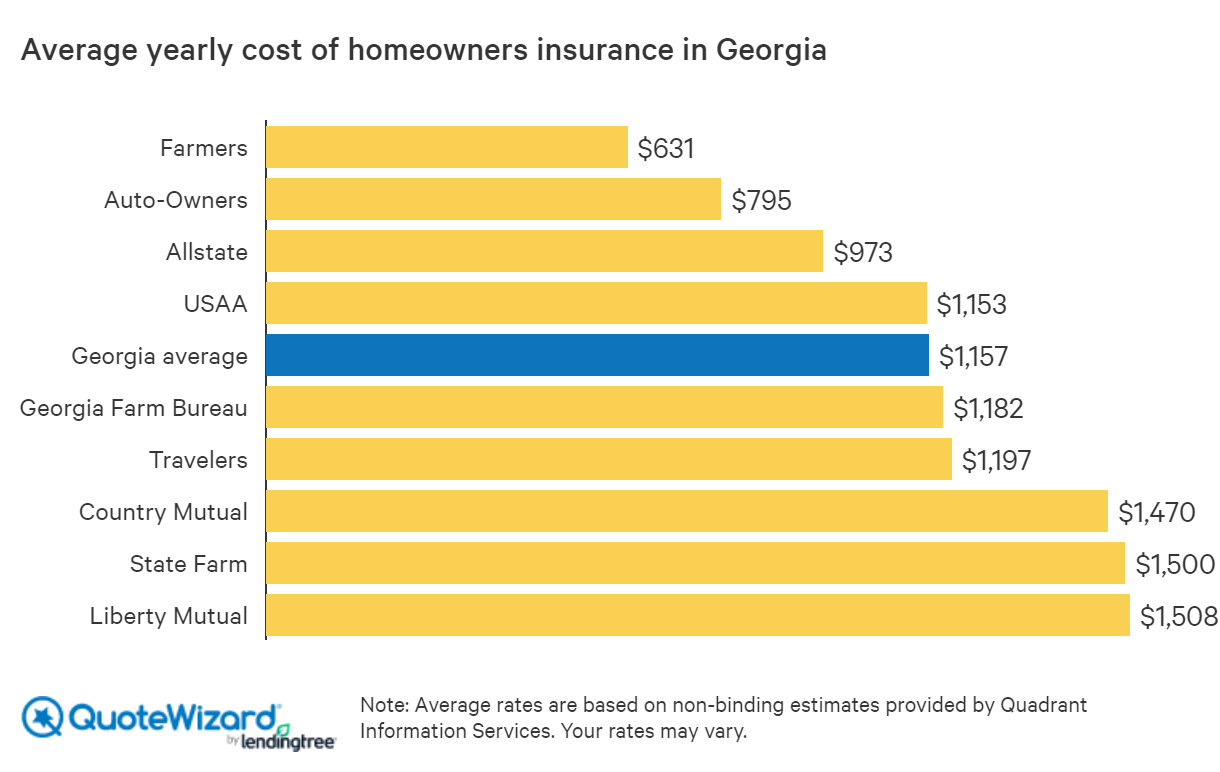

Homes in Atlanta, on average, are going for $313,818, while homes in Savannah are going for $198,625. However, localities can add to that total, which can vary your cost of living a lot. In L.A., the sales tax rate is 9.5 percent, but this is only in the city itself. Though some neighboring places still feel like L.A., they can have a completely different sales tax. The rise in mortgage rates in recent weeks is an unwelcome trend for home shoppers this spring homebuying season.

The average rate on a 30-year mortgage has now increased for four weeks in a row. The latest uptick brings it to its highest level since Nov. 30, when it was 7.22%. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points lower. The rising cost of homeownership means sellers and buyers should enter today's market with lowered expectations, said Redfin economic research lead Chen Zhao. The tool automatically checks for updates from the FHFA (home prices) and Bureau of Labor Statistics (CPI) once a week.

Cheapest Places to Buy a House in the US in 2024 - Norada Real Estate Investments

Cheapest Places to Buy a House in the US in 2024.

Posted: Sun, 21 Apr 2024 07:00:00 GMT [source]

According to the data we collected, buying a home will cost a bit less in January 2023 than it did in October 2022, when The Balance last compiled the data. Our research showed that it costs 7.55% less to buy a home in January than it did in October, after figuring in the down payment, closing costs, and first monthly payment. Oklahoma is the state with the fourth lowest typical house price in the United States.

How Much Does It Cost To Build A House? - Zing! Blog by Quicken Loans

How Much Does It Cost To Build A House?.

Posted: Fri, 23 Feb 2024 08:00:00 GMT [source]

The median income in Idaho is 2% less than the national average, and mortgage payments are an average of 43.5% of that income. Mortgage rates are at historic lows, and many homebuyers want to get a mortgage at those low rates while they can. There are many places, though, where the inventory of houses doesn’t meet the demand of homebuyers—and as a result, home prices are fluctuating. Whether you want to buy a new house in your state, buy a house in a different state, or even sell your home, it’s important to know how much a home, on average, costs. Let’s take a look at the average house price in each state as of April 2021. Closing costs might include appraisal fees, title insurance, prepaid property taxes, insurance, and interest.

While the state’s home prices have grown at about the same rate as the country’s (38% vs. 36%), mortgage payments require a far lower percentage of income in Oklahoma (25% vs. 39%). Don’t let the low prices fool you—Ohio’s housing market is competitive. In September 2023, 35.5% of homes sold above their listing prices, according to Redfin.

No comments:

Post a Comment